A Swap Transaction Consists of Which of the Following

This type of market consists of foreign-exchange transactions that are to be consummated immediately. A spot foreign exchange transaction and a forward foreign exchange transaction.

As Shared Economies Grew They Are Becoming Victims Of Their Own Success Some Of The So Called Sharing Platforms Have Become Indispensabl Solutions Token Swap

An arbitrage is the difference in the exchange rate.

. - GitHub - alanwhite1203fxSwap. A foreign exchange swap or currency swap is a contract under which two parties agree to exchange two currencies at a set rate and then to re-exchange those currencies at an agreed upon rate at a fixed date in the future. Swap consists of an agreement hetween two entities called counterparties to exchange in the future two streams of cash flows.

They occur if both companies have a currency that the other requires. It is measured in Gwei. Is a foreign exchange transaction that is consummated immediately B.

The average daily swap transaction amount. Involves a transaction in which the same currency is bought and sold simultaneously. This theory states that the prices of tradable goods when expressed in a common currency will tend to equalize across countries as a result of exchange rate changes.

In order to address this problem decentralized crypto exchanges such as Uniswap UNI PancakeSwap CAKE or SushiSwap SUSHI have been developedThese exchanges act as purely decentralized entities and allow their users to exchange swap tokens freely with no requirements to use their platform as opposed to lengthy KYC Know Your Customer. These two legs are executed simultaneously for the same quantity and therefore offset each other. An all in cost consists of A interest expense B transaction costs C service.

In foreign exchange swaps there are two legs a spot transaction and a forward transaction. Is a foreign exchange transaction that occurs sometime in the future C. The transaction consists only of the.

The swap points indicate the difference between the spot rate and the forward rate. Signing an outgoing transaction send BTC. A spot transaction and a forward transaction.

A swap is a custom tailored bilateral agreement in which cash flows are determined by applying a prearranged formula on a notional principal. A swap execution facility that offers a request for quote system in connection with Required Transactions shall provide the following functionality. 20 of bridge fees are used to buyback and burn ANY tokens which take place once every quarter.

The agreement consists of swapping principal and interest payments on a loan. Then the schedule S must contains the following non -swappable actions in this order. The transaction type defines what degree of specialization of the transaction category purchase sale or swap is involved in the current transaction.

In order to make a serial schedule we must make the following swap. From a users perspective a swap consists of. Involves currencies that are not freely tradeable D.

In this type of swap transaction the foreign currency rate may be taken advantage of by banks due to the arbitrage. Borrowers entering into a financing with a swap should understand that the mid-market rate can move significantly between the signing of a term sheet and the closing of. In financial markets the two parties to a swap transaction contract to exchange cash flows.

Course Title FINA 4410. The price of Gas is the amount of ETH that you are willing to spend on each unit of Gas. As described above a swap rate is comprised of two componentsthe objective structure-specific mid-market rate and the transaction-specific credit charge or mark-up added to it.

Pages 74 This preview shows page 13 - 16 out of 74 pages. It is a bilateral agreement between individuals or entities to exchange cash flows payments over a specified period and rate. It may involve an intermediary or a swap bank who brings together the counterparties for a premium.

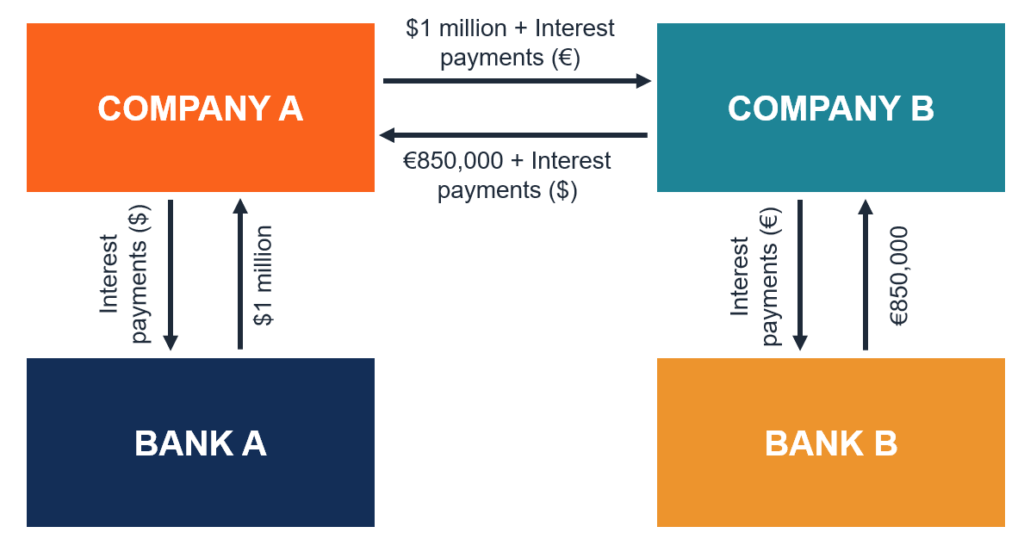

To accept the offer the user has to provide the address where to receive the ETH and send 005 BTC to the address provided by the swap provider. This transaction consists of one Swap product for each underlying quoted. A forex swap consists of two legs.

Both are executed at the same time for the same quantity and therefore offset. Therefore an FX swap consists of two transactions. I At the same time that the requester receives the first responsive bid or offer the swap execution facility shall communicate to the requester any firm bid or offer pertaining to the same instrument resting on any of the swap.

A swap in simple terms can be explained as a transaction to exchange one thing for another or barter. These can be better explained with the following examples. One is currency swap and the other is interest swap.

Currency swap in swap transaction. You define the permitted transaction types during system configuration. You can use the following input help.

Suppose the cycle consists of the transactions T 1 T 2 T k. Wei is the smallest unit of Ether 1. Users can use ANY tokens to pay for bridge fees.

A foreign currency swap also known as an FX swap is an agreement to exchange currency between two foreign parties. The fee is calculated based on the GAS ETH exchange rate for every transaction. The most commonly encountered types of currency swaps include the following.

Configuration How it Works SWAP Long Swap. Other common swap transactions include currency swaps debt swaps and commodity swaps. The project consists of the following major components working in conjunction.

In a currency swap these streams of cash flows consist of a stream of interest and principal payments in one cvtrrency exchanged for a stream of interest and principal payments of the same maturity in another currency. Types of swap transactions. For example they may offer to swap 005 BTC for 014 ETH.

BitKeep - Asias leading decentralized multi-chain wallet is pleased to announce its multi-chain wallet has reached five million in transaction volume. There are two types of swap transactions. On calculation date if the underlying reference price settles above the trade price you receive an amount equal to the underlying reference price less the trade price times the notional quantity.

Float swap is commonly referred to as basis swap. 211 Features of Swap Transactions A typical swap transaction has the following characteristics. An all in cost consists of a interest expense b.

A swap transaction _____. In a basis. One leg of the currency swap represents a stream of fixed interest rate payments while another leg is a stream of floating interest rate payments.

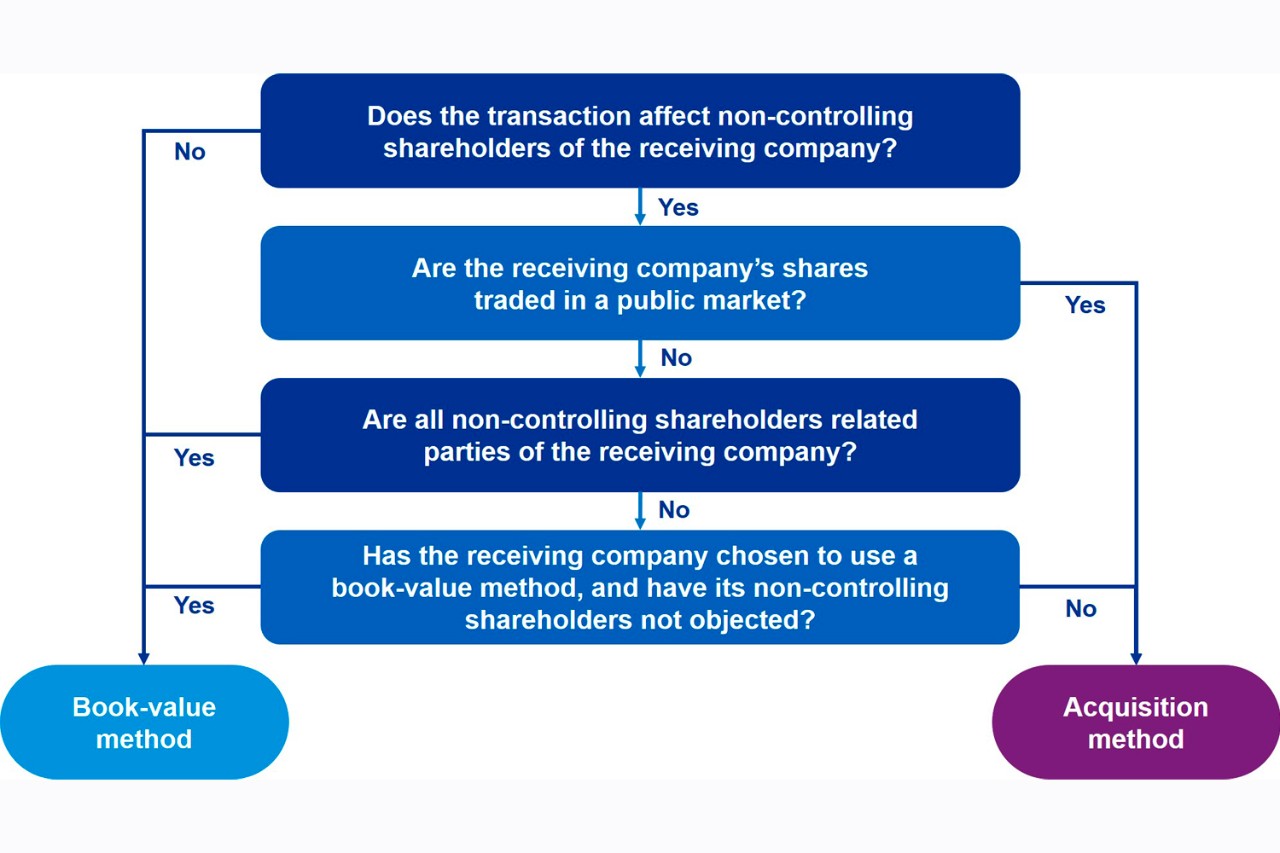

Business Combinations Under Common Control Kpmg Global

Know More About Tbt Token Book Cover Learning

Pin On Graphics Design Branding Visual Identity

Diy Photo Graduation Chip Bag Try Before You Buy Custom Etsy Diy Photo Chip Bag Brochure Paper

It Is Cookie Time Svg Girl Scout Svg Cookie Svg Girl Scout Etsy In 2021 Girl Scouts Svg Cookie Time

Binance Launches Otc Trading Desk Following Bittrex Bitcoinminingsoftware Otc Trading Cryptocurrency News Blockchain

Various Iris Folding Patterns Card Making Iris Paper Folding Iris Folding Iris Folding Pattern

How To Fix Pancakeswap Waiting For Confirmation Dialog Box Fix It Dialogue Confirmation

How To Fix Pancakeswap Transaction Cannot Succeed Error Fix It Succeed Error

Bill Of Lading Templates 24 Free Printable Xls Docs Invoice Template Budget Spreadsheet Template Templates

Read More About How To Build A Successful Business On Tipsographic Com Success Business Cash Flow Infographic

Red True Bank Universal Multipurpose Bank Account Refer Reference Letter Reference Letter Template Bank Account

Pin By Tanya Brennan On Scouting Crafts Daisy Girl Scouts Girl Scouts Brownie Girl Scouts

Currency Swap Contract Definition How It Works Types

Bitcoin Plunges Following Failed Breakout Miner Selling Pressure Ramps Up Bitcoin Breakouts Pressure

:max_bytes(150000):strip_icc()/DifferentTypesofSwaps2-4de5ab58b9854ca6b325de77810c3b16.png)

:max_bytes(150000):strip_icc()/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)

Comments

Post a Comment